Best AI Rank Tracking Tools for 2026

If you're a B2B marketer who's starting to see traffic and conversions from ChatGPT, Perplexity, or Gemini, you're not alone. In fact, more and more marketing teams are logging into Google Analytics or CRM dashboards and asking:

“Why are we suddenly getting traffic from LLMs?”

“Can we do anything to increase it?”

“What the hell is an AI visibility tool anyway?”

Welcome to the new frontier of search: AI Search Optimization (AISO). And with it comes a flood of tools for generative AI rankings that claim to help but rarely deliver. Let’s unpack what these tools actually are, how they differ, and what makes some more useful than others. If you're still wrapping your head around AISO, our AI Search Optimisation guide breaks it down step by step: from how LLMs generate answers to what influences recommendations.

First, What Even Is an AI Rank Tracking Tool?

When we at Chosenly.com first started describing ourselves as an “AI visibility tool,” we weren’t trying to be vague. We were literally responding to search behaviour. People were typing that into Google. CMOs were seeing traffic in their CRMs from ChatGPT, Perplexity, or Gemini. And that traffic was growing 10–15% every single month, with zero spend or effort.

Naturally, they asked:“Where is this coming from? “What did someone ask to land here?", “Can I 2X this?”

And the big one:

“Is there a Google Search Console... but for AI search?”

Sadly, unlike traditional search, there’s no “Google Search Console for ChatGPT.” No clear dashboard or obvious keyword list.

Unlike keywords with volume, AI search is driven by facts, structure, and what the model remembers. Start with structured content, FAQs, and consistent language around key use cases.

In AI search, you don’t control who asks what, you don’t even know what they asked but you do know they found you somehow and converted.

So the hunt begins for tools for AI rank tracking. Something (anything) to decode how you’re showing up in ChatGPT and similar models.

And that’s where things get messy.

Marketers started searching for an equivalent. And a slew of tools responded, all promising to show your “visibility” on LLMs.

But “visibility” in this world is… slippery. Why? Because instead of ranking links, LLMs like ChatGPT generate entire responses. That means: -Different users get different answers - Same prompt, different day = different results - most prompts don’t have search volume. They’re one-off conversations

Welcome to the chaotic new world of tools for AI rank tracking system. If you've tested SEO-first platforms trying to retrofit AI features like Semrush, Ahrefs, or Mangools, you’re not alone. We compared all the major tools in our LLM SEO tools breakdown.

Okay… So What Do AI Rank Tracking Tools Actually Do?

The hunt is on for AI search tracking platforms that can decode how you’re showing up in tools like ChatGPT or Perplexity and why. Let’s break them into 3 rough buckets. You’ll find pretty much every tool falls into one of these:

Bucket 1: Cheerful API Wrappers

These are the simplest of the bunch. You paste in prompts you think your audience might ask. The tool runs those through ChatGPT’s API, captures the answers, and lets you see if your brand was mentioned.

Think of it like:

A Google Sheet

- OpenAI API access

- CTRL+F for your company name

They’ll often give you a “visibility score” like: “You showed up in 12 out of 50 prompts!”

Sounds helpful at the first glance, but as we explained in our blog on optimizing your website for ChatGPT:

- You chose the prompts

- They treat prompts like keywords (which doesn’t work)

- You have no idea if buyers are actually asking those

- Re-run the same prompts tomorrow? Get different results

For example, we’ve literally seen marketers run this in Notion or Airtable. One team pasted 50 prompts into a spreadsheet, ran them through GPT’s API, searched for their brand, and celebrated a “24% visibility score.” But they had no idea what to do with it.

Pros:

- Affordable (some start at $19–$49/month)

- Easy to use

- Good for MVP-level curiosity

It’s like someone telling you your name didn’t appear in a conversation but not telling you what to say to fix it.

Bucket 2: Prebuilt Indexes (Ahrefs, Semrush, etc.)

These are the big guys. They don’t let you input prompts. Instead, they claim to track all major AI search queries in your category and tell you where your brand shows up.

Ahrefs Brand Radar is the poster child here. Their model is basically:“We built a massive index of prompts and answers. Pay us to see where your brand shows up.”

Pros:

- You don’t have to guess prompts

- You get a visibility list out of the box

- Feels automated and data-rich

Cons:

- You still don’t know why you showed up

- You can’t control what gets tracked

- May not have anything relevant to your niche

- Super expensive (starts around $699/mo and can go to $3,000+/mo)

Also, If you're in a niche B2B category (like “SOC2 tools for fintech startups”), there's a good chance their index doesn’t even include your real buying journeys.

One longtime Ahrefs user put it best: “I have an Ahrefs subscription. They have an AI search tool. I’ve been a customer for 10 years. So it’s very cool. All the data that they share is very cool to see, but I’m not sure how to use this information.”

Bucket 3: Platforms That Actually Try to Be Useful (Shameless plug, Hello Chosenly 👋)

This is the rarest category. These tools don’t stop at “Did I show up?” Instead, they help you figure out what to track, why it matters, and what to do next.

At Chosenly, we realized early on:

B2B teams don’t need another dashboard. They need a workflow. So we built a platform that answers five real questions:

1. Guide – What prompts should I be tracking?

We don’t expect you to know. We analyze your industry, competitors, and customer segments, then guide you toward the 4 types of prompts that actually matter:

- “Who are the best X vendors?”

- “What tools help solve Y?”

- “Compare X vs Y”

- “Tell me about company Z”

2. Gather: Am I being cited accurately? (And how often do I show up vs. competitors?)

Chosenly.com goes beyond just checking if you show up. We:

- Track mentions across public LLMs (ChatGPT, Claude, Gemini)

- Log hallucinations and misrepresentations

- Show where competitors are being picked instead of you

3. Act: “What should I do about it?”

Chosenly gives you:

- Outreach opportunities (who cited your competitors, but not you)

- Content ideas (based on gaps in prompts)

- Messaging audits (e.g., your brand shows up for “cheap X” but not “enterprise-grade X”)

If LLMs hallucinate outdated logos, fake pricing, or old customer logos, correct it first. Chosenly highlights hallucinations so you can quickly patch what’s actively hurting your credibility.

4. Measure: “Is any of this working?”

We connect visibility actions to:

- LLM-sourced trafficDemo volume

- Pipeline metrics

So you can prove ROI from your AI search efforts.

Use UTMs and demo notes to connect prompt influence with pipeline impact. Seeing ChatGPT in referral notes? Track those leads and build your business case.

5. Expand “How do I scale this?”

Once you have a loop working, Chosenly helps extend it across:

- SEO teams

- Content writers

- PR managers

- PMMs

Most tools stop at #2. Chosenly is built for the entire loop.

Why Most Tools Still Miss the Point

Despite all the noise in the space, most tools for AI rank tracking & evaluation fall short in three critical ways that make them unreliable, misleading or just plain unusable.

1. Prompt Uniqueness

AI search queries aren’t “keywords.” They’re natural language, highly contextual prompts. And in B2B especially, two prospects looking for the exact same thing will never phrase their requests the same way.

For example:

- “We’re a GDPR-compliant fintech startup looking for a zero-trust security vendor.”

- “Best cloud security tool for EU-based fintech companies with regulatory requirements.”

These mean the same thing but share almost zero lexical overlap. Most tools track visibility by fixed prompts. If you don’t guess the exact phrasing a buyer used, the tool won’t flag it even if you did show up.

The implication?

- You're underreporting true visibility

- You’re blind to your actual win moments

- You optimize for prompts that don’t matter

Chosenly.com solves this by clustering prompts based on buying intent themes not exact phrasing. This allows visibility reporting to reflect real demand-side language.

2. Context-Aware Search

Tools like ChatGPT personalize results not just based on the query, but the entire chat history and user profile. This means:

- A startup CMO and a Fortune 500 IT director will get different answers to the same prompt

- Someone who’s previously asked about HubSpot will get answers skewed toward its ecosystem

- Previous clicks, user tone, and preferences affect how brands are framed

Yet most rank trackers run prompts in a clean slate mode, API calls with no user history or context.

The result?

- You think you’re not visible… when you are

- Or worse, you think you’re showing up when you're not for your actual ICP

Chosenly is working to account for context through prompt personas, grouping prompts by ICP archetypes (e.g., mid-market PMM, enterprise security head). This way, you understand how your actual buyer sees you in AI-generated answers.

Ask yourself: Would this buyer have interacted with Salesforce, HubSpot, or Notion before? LLMs are trained on context, so showing up once may not mean you’ll show up again, or for the right audience.

3. Follow-Up Chains

This is perhaps the biggest blind spot. In traditional search, a buyer may refine queries over multiple Google searches. But in AI, they iterate in the same conversation.

Real buying journeys look like this:

- “Who are the best ISO compliance platforms?”

- “Which of these supports HIPAA too?”

- “What’s the difference between Secureframe and Drata?”

Visibility in just one of these prompts doesn’t cut it. Most tools track only the first-level query. But that’s not where decisions are made.

Chosenly addresses this by:

- Tracking multi-prompt threads

- Reporting drop-offs in follow-up visibility

- Suggesting where and how to insert facts (like SOC2 readiness, integrations, pricing clarity) to improve mid-thread performance

This is visibility that maps to the real decision-making path, not just the first question.

How Do You Know If You’re Ready for AISO Tools?

If you're asking any of these questions:

- "Where is this ChatGPT traffic coming from?"

- "Why are we showing up in LLMs without trying?"

- "Can we double that impact if we do try?"

You’re ready.

To assess:

- Check CRM referrals: Are ChatGPT, Perplexity, or Gemini showing up?

- Ask inbound leads: “Where did you hear about us?”

- Look at demo notes: Do they mention AI tools?

If the answer is yes to any of these, and you’re seeing LLM visibility grow steadily say 40% over six months you’re probably sitting on a compounding channel.

It cost Spear Growth around $400 for the Chosenly tool and another $2,000 to $4,000 on personnel, outreach, and other related efforts. Within a month of working on this, they closed $100,000 in revenue through AI search- crazy ROI for a test run.

It’s not a speculative channel anymore. It’s performance marketing’s weird, invisible twin.

Red Flags When Choosing Tools for AI Rank Tracking

Watch out for these gimmicks and traps:

1. Visualizations With No Action Layer

If a tool gives you trendlines and pretty graphs without next steps, ask:

- “What changes should I make on my site?”

- “Which prompts should I improve?”

- “What PR do I need to fix this?”

If the tool can’t answer those skip it.

2. Sentiment Analysis as a Feature

A lot of tools for AI rank tracking & analysis that offer sentiment graphs or sentiment scores for B2B queries like “best SOC2 vendors” are pointless. There’s barely any emotional language to analyze. Worse, they create a false sense of insight.

3. LMS.txt and Similar Gimmicks

Unless a feature directly influences how LLMs fetch or present answers, it’s noise. Ask: “Will this improve how ChatGPT sees my brand?” If the answer is fuzzy, it’s not worth your dev time.

4. “One Tool Fits All” Positioning

AI search works differently across:

- B2B SaaS

- B2C commerce

- Local service providers

If a platform claims to serve all of these without segmentation, it’s either oversimplified or over engineered.

For eg, Chosenly.com is built specifically for B2B teams.

Ecom tools often focus on product citations. Local SEO tools optimise for maps and reviews. But if you're in B2B SaaS, you need prompt clustering, hallucination logs, and competitive comparison prompts, not product reviews.

Full List of Best tools for AI Rank Tracking (2026)

1. Chosenly.com

Chosenly.com is one of the most advanced and specialized platforms for AI Search Optimization, designed primarily for B2B SaaS companies, mid-market service providers, and agencies.

Pricing: Starts at $200/month

The platform is available in both SaaS and services models. Its pricing starts at $500 per month for the base plan, goes up to $800 for the plus plan, and extends to $1200 or $2100 per month for 3 or 7 custom reports respectively.

For teams looking for hands-on implementation support, Chosenly also offers a $12,000 full-service sprint over three months.

Pros:

- Instead of just tracking visibility or brand mentions, it guides marketing teams on what to fix, what to create, and where to focus to actually show up for high-intent prompts inside tools like ChatGPT

- It connects with Google Analytics 4, Search Console, and CRM platforms to track traffic and pipeline from AI tools

- It also highlights where LLMs are misrepresenting your brand and shows how to fix it with factual content or PR

- Teams get Slack support and templates, making it feel more like a consulting partner than a typical SaaS dashboard

Cons:

- Chosenly's UI is still evolving

- It’s not yet suited for very small companies or mega-enterprises, but mid-market brands will find its depth unmatched

2. Prompt Screener

Prompt Screener is a lightweight way to check if your brand shows up in AI responses. You paste prompts you think buyers might ask, the tool runs them through ChatGPT, and you get a “visibility score” such as “14 out of 50 prompts.”

Pricing: Starts at $99/month, with a free trial option

Pros:

- Quick setup and minimal learning curve

- Provides prompt-based visibility percentages and competitor comparisons

Cons:

- Treats prompts like keywords, which buyers don’t use

- No insights on why you did or didn’t show up

3. Trackerly.ai

It's a dashboard tool for tracking how often your brand shows up across ChatGPT, Gemini, Claude, Perplexity, and DeepSeek. It gives you a share-of-voice style score and visibility trends, making it easy to see shifts but without guidance on what to do next.

Pricing: Starts at $27/month and goes upto $247/month

Pros:

- Covers multiple LLMs beyond ChatGPT

- Tracks visibility share and trends over time

Cons:

- No misrepresentation or context tracking

- Reports “if” you showed up but not “why”

4. BrandSignal AI

BrandSignal AI monitors how AI tools mention your brand. It highlights mentions and gives simple charts for visibility tracking

Pricing: $29/month

Pros:

- Logs brand mentions in AI answers

- Easy interface for trend tracking

Cons:

- No guidance to fix inaccuracies or gaps

- Doesn’t tie visibility to traffic or pipeline

5. RankScale

RankScale is positioned as an entry-level DIY tool for teams looking to dip their toes into LLM optimization.

Pricing: Starting at just $29/month

Pros:

- It tracks basic visibility metrics and offers lightweight content suggestions

- It's one of the most affordable tools on the market

Cons:

- RankScale doesn’t offer strategic guidance, support, or recommendations specific to your ICP

6. BrandBeacon.ai

It tracks whether and how often your brand appears in AI-generated answers. It offers trend reports and a simple view of presence across models.

Pricing: Not disclosed publicly

Pros:

- Shows visibility trends over time

- Easy setup for testing AI exposure

Cons:

- Only answers “Did I show up?”

- Ignores prompt variation and user context

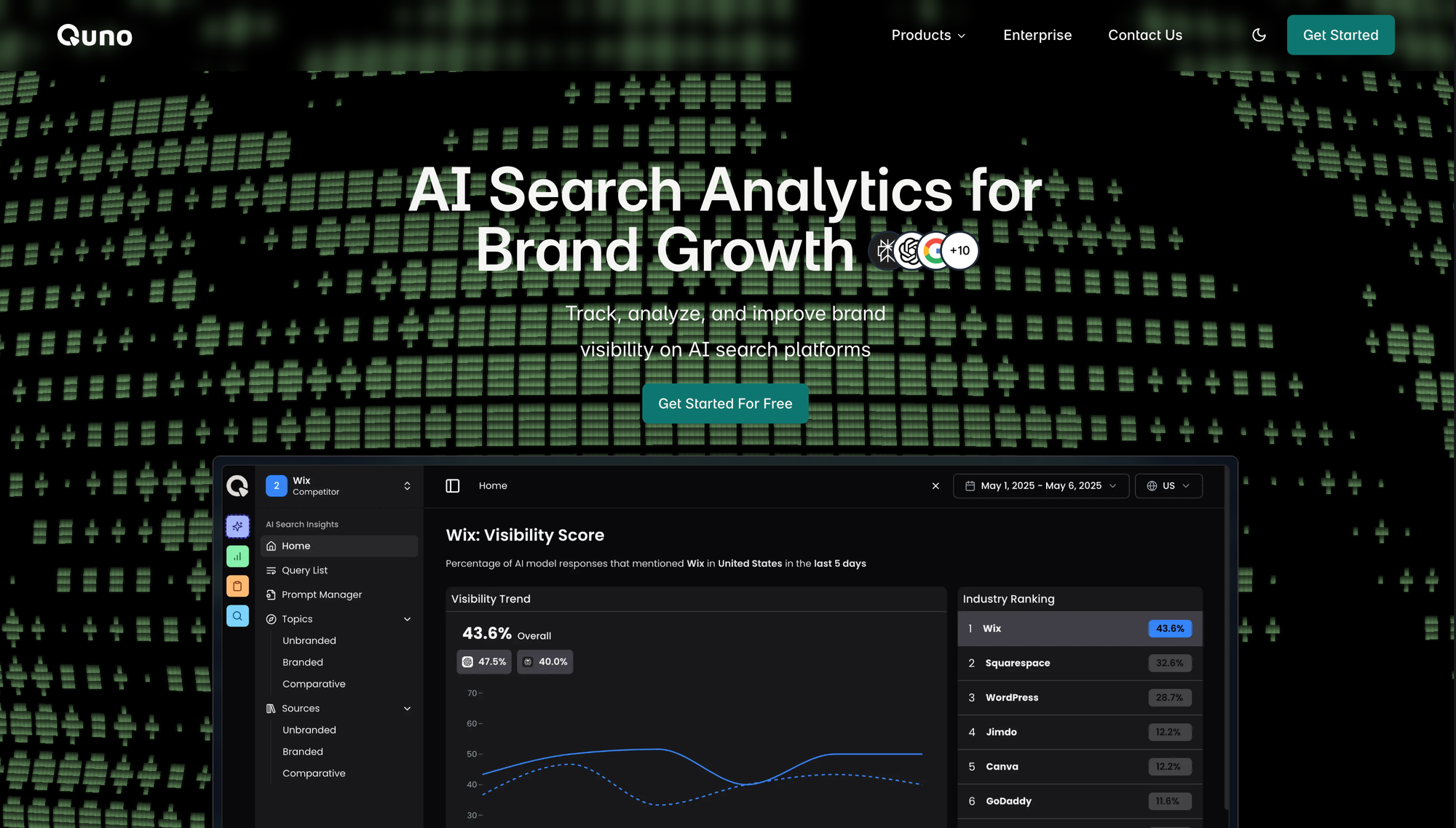

7. Quno.ai

It runs prompts through ChatGPT and tells you how often your brand was mentioned

Pricing: Not disclosed publicly

Pros:

- Fast way to check mentions in AI responses

- Provides simple mention frequency stats

Cons:

- Just confirms presence, nothing deeper

- Doesn’t help expand or improve visibility

8. Keyword.com

It has added an “AI visibility” feature to its traditional rank tracker. It shows whether your brand comes up in ChatGPT and tracks shifts over time.

Pricing: Starts at $3/month, with a free trial option

Pros:

- Recognizable dashboard experience for SEO users

- Tracks AI mentions alongside traditional SERPs

Cons:

- Treats prompts like static keywords

- No correction for hallucinations or gaps

9. Nightwatch

Nightwatch has extended its SEO rank tracking to include LLMs. It mimics SERP-style charts for ChatGPT and Claude, showing if you showed up and where.

Pricing: Starts at $32/month, with a free trial option

Pros:

- Easy SERP-like visuals for AI mentions

- Integrates with existing SEO workflows

Cons:

- Only reports mentions, no context

- Treats LLM outputs like static ranks

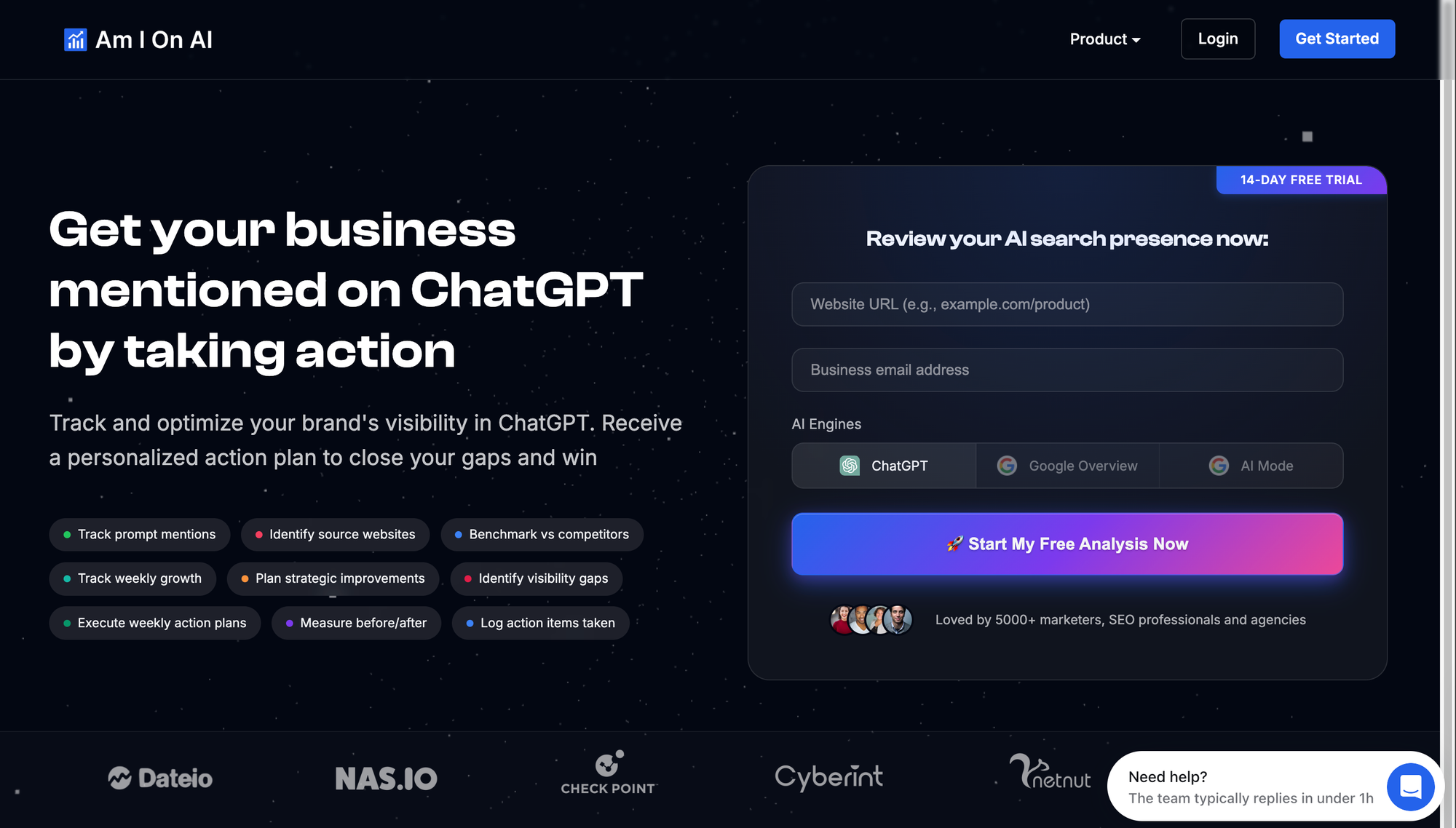

10. Am I on AI

Am I On AI is the simplest of the bunch: enter your brand, pick a model, and see if it shows up.

Pricing: Starts at $100/month, with a free trial option

Pros:

- Extremely easy to test in seconds

- Low cost for experimentation

Cons:

- Just a binary “in or out” checker

- No scalability, strategy, or improvement

Let me leave you with this…

Just “showing up” in ChatGPT isn’t really the win. That’s just step one. The real win is being the top choice when someone asks an LLM:

“What’s the best tool for X?”

“Who should I go with this or that?”

“Tell me more about this company, are they legit?”

Because whether you realise it or not, that’s already happening. Your buyers are doing this today: they’re typing prompts like that into ChatGPT, Claude, Gemini, Perplexity and whatever answer they get shapes who they reach out to, who they trust, and who ends up making it into their final 2–3 vendor shortlist.

So if you're relying on some $20/month tool that just tells you “Hey, your name came up in this prompt,” but doesn't tell you why, or how often, or what to do to change that... then you're just watching from the sidelines, hoping it works out.

And hope isn’t a strategy.

What most people don’t realise yet is that LLM search isn’t about keywords or backlinks. It’s about facts, context, and credibility.

It’s about what you’ve put out there (or failed to), and whether those LLMs have enough to go on to recommend you with confidence.

So the question isn’t just, “Am I showing up?”

It’s:

- Am I showing up for the right things?

- Do I even deserve to win the recommendation based on what’s out there?

- What are my competitors doing better than me in AI search that I haven’t even noticed?

That’s why tools like Chosenly.com exist. Chosenly was built not just to tell you where you are, but to tell you exactly what’s missing, what to fix, who to reach out to, what to add to your site, what content to create next, and whether any of that is actually working across prompts, pages, traffic, and pipeline.

We’re not selling a dashboard. We’re giving you a full playbook. One that evolves every week, based on what the LLMs are actually doing, what they’re citing, and what’s changing in how buyers are searching.

So if you’re already seeing traffic from ChatGPT or Perplexity, or even if you’re just getting those early signals that people are researching you through AI tools, this is the time to take it seriously.

And if you’re not seeing that yet- great. You’re early. You still have time to get ahead of the pack before everyone wakes up and starts scrambling for visibility in an ecosystem where the old SEO tricks don’t work anymore.

👉 Book a strategy call on Chosenly.com and we’ll show you what AI tools are currently saying about your brand, what they’re missing, and what you can do to own more of those buying moments.

Want to go deeper? Explore our blog archive for more on AISO strategies, prompt behavior, and what’s changing in AI search.

FAQs

1. How do I rank in AI search?

Short answer: You don’t “rank,” you get recommended. LLMs generate answers based on a combination of:

- The sources they trust (listicles, PR sites, review platforms)

- The information they can find about you (on your site, docs, etc.)

- The criteria users care about (pricing, compliance, integrations, etc.)

So your job is to:

- Show up on the sources LLMs already trust

- Add missing info to your web presence

- Monitor prompts that drive buying decisions

- Fix anything they’re getting wrong about you

2. Are AI rank tracking software accurate?

Depends on how they work.

Most of them run prompts once. The problem? LLMs are chaotic. Run the same prompt 3 times, and you’ll get 3 different answers.

That’s why Chosenly runs prompts multiple times and captures variations. This gives you a stable visibility score over time, rather than random spikes and dips.

So yes some tools are accurate enough, but only if they account for LLM inconsistency.

3. Can I just use GA4 and Search Console to track this?

Kinda. But only for lagging indicators like:

- How many users came from ChatGPT links (via UTM)

- Whether they converted (sessions → SQLs)

But here’s what those tools can’t tell you:

- Why ChatGPT mentioned you in the first place

- What you’re missing compared to your competitors

- What prompts or facts LLMs are using to form opinions

To influence the algorithm, you need to see leading indicators: what’s showing up before traffic happens.

Only tools like Chosenly.com do that.

4. Who should own AI search optimisation inside a company?

The best setup we’ve seen:

- SEO owns the strategy PMMs own the narrative

- Content team creates assets PR team does outreach

- Chosenly sits at the center and connects it all

And honestly? SEOs are the only ones used to coordinating across all of those teams. So let them lead even if they’re not the ones writing the copy or pitching PR.

5. Is AISO only for demand gen, or does it help with brand as well?

Both. The most successful Chosenly users use it across brand, demand, content, and PR. That’s because LLMs cite sources, shape perception, and influence buying, often before a lead hits your CRM.

6. What’s the fastest way to win in LLM search today?

Start by fixing hallucinations and gaps in high-intent prompts. Then add missing facts to pages LLMs are already citing. Most companies start seeing results in 2–4 weeks when they do this.

7. Is this just another version of SEO tools hyping up AI?

No. True AISO platforms are built from the ground up for prompt variation, model behavior, and hallucination correction. SEO tools that added an "AI tab" are often just wrapping their old data in a new UI.

8. Why is tracking visibility hard in AI search?

Because:

- Prompts vary by user

- Answers change daily

- AI results depend on history and context

- Follow-up prompts shape decisions, not the first one

9. What’s the minimum signal that says I should invest in this?

If ChatGPT or Perplexity shows up in your CRM, GA4, demo calls, or lead notes, that’s your cue. Early visibility is compounding.